Grocers, cafés and other businesses — big and small — in Delhi, Mumbai, Bengaluru and elsewhere have been seized by uncertainty after the Reserve Bank of India (RBI) cracked down on Paytm Payments Bank on January 31 for not complying with regulations.

Rivals such as PhonePe and Google Pay are using the opportunity to port Paytm accounts to their own platforms at no cost. And, Paytm representatives have reached out to some merchants and begun transferring their deposits to other banks.

Elevate Your Tech Prowess with High-Value Skill Courses

| Offering College | Course | Website |

|---|---|---|

| IIM Lucknow | IIML Executive Programme in FinTech, Banking & Applied Risk Management | Visit |

| Indian School of Business | ISB Professional Certificate in Product Management | Visit |

| IIT Delhi | IITD Certificate Programme in Data Science & Machine Learning | Visit |

Paytm has also been sending advisories through WhatsApp to users, asking them to change their linked bank accounts to other lenders for “faster and safer settlements,” while assuring them their money is safe.

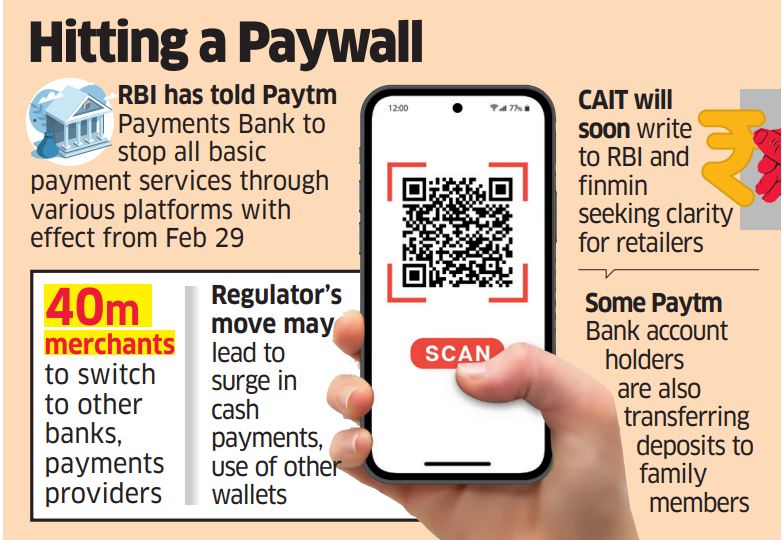

The RBI ordered Paytm Payments Bank to stop all basic payment services through various platforms and digital avenues, including the Unified Payments Interface (UPI), with effect from February 29. The regulator also barred it from offering banking services, such as accepting deposits and processing payments.

Also read | Also read | India financial crime fighting agency will probe Paytm Payments Bank if money laundering found

A PhonePe spokesperson told ET there’s been a rise in merchants looking to switch.

“Onboarding new merchants and servicing the existing ones is the main part of a field sales representative’s daily work,” the person said. “We are seeing a surge in inbound requests from merchants for QRs (QR codes) and SmartSpeakers (that issue audio alerts when payments are made) and we are making sure we are meeting that demand.”

A GPay spokesperson said the company is continuing to support its merchants and users as required and “no incentives have been offered to any merchants in this regard”.

Paytm chief operating officer Bhavesh Gupta told stock market analysts on February 1 that about 40 million merchants will need to be moved to other banks and that the process had already started.

Also read | The week that was: Hope and despair on Startup St., and other top tech stories

Paytm did not respond to ET’s queries till press time.

Shopkeepers at a market in central Delhi said Paytm representatives had visited them on Friday.

“We received all the money from the shop in the Paytm bank account. Today, someone came and said the account will be blocked, so I had it transferred to my SBI account,” said photocopy shop proprietor Sushant, who uses only one name.

Some are questioning the stability of the digital payments ecosystem, wondering if rivals could suffer the same fate. Retailers have adapted to online payments over the past few years.

Also read | Breaches piling up for seven years at Paytm Payments Bank

“Even a sabziwala has now become” habituated to digital payments, said Praveen Khandelwal, national secretary of the Confederation of All India Traders (CAIT), which represents about 150,000 retailers and small businesses.

The move will be disruptive, given the lack of information. “The larger worry is what kind of noncompliances have led the RBI to take such a big step,” he said. “Should we now depend on banking apps which provide UPI and wallet services? Are they more reliable than these large private companies?”

CAIT will soon write to the RBI and the finance ministry seeking clarification for retailers on the next steps, he said.

Confusion prevails

Paytm Payments Bank account holders are also transferring deposits to family members. Users such as autorickshaw drivers and small grocers are confused about what will work going forward. Others aren’t sure about what’s happened. “Someone was telling me that RBI has taken over Paytm and our money is safe,” said a stall owner at Mumbai’s Chhatrapati Shivaji Maharaj Terminus (CSMT).

“I will change my QR code to PhonePe tomorrow but the speaker will cost me `500 extra.” Restaurant owners expect a rise in cash payments and the use of other wallets in the near term.

Mobile phone retailers said they have stopped accepting Paytm payments until clarity emerges. A “single store does business of Rs 5-10 lakh per day, of which 70% is collected through UPI and cards,” said Vibhooti Prasad, who runs 138 mobile retail stores in Mumbai and was referring to average daily turnover per outlet. “We cannot risk that amount of money, so we have stopped Paytm collections until clarity emerges.”