Synopsis

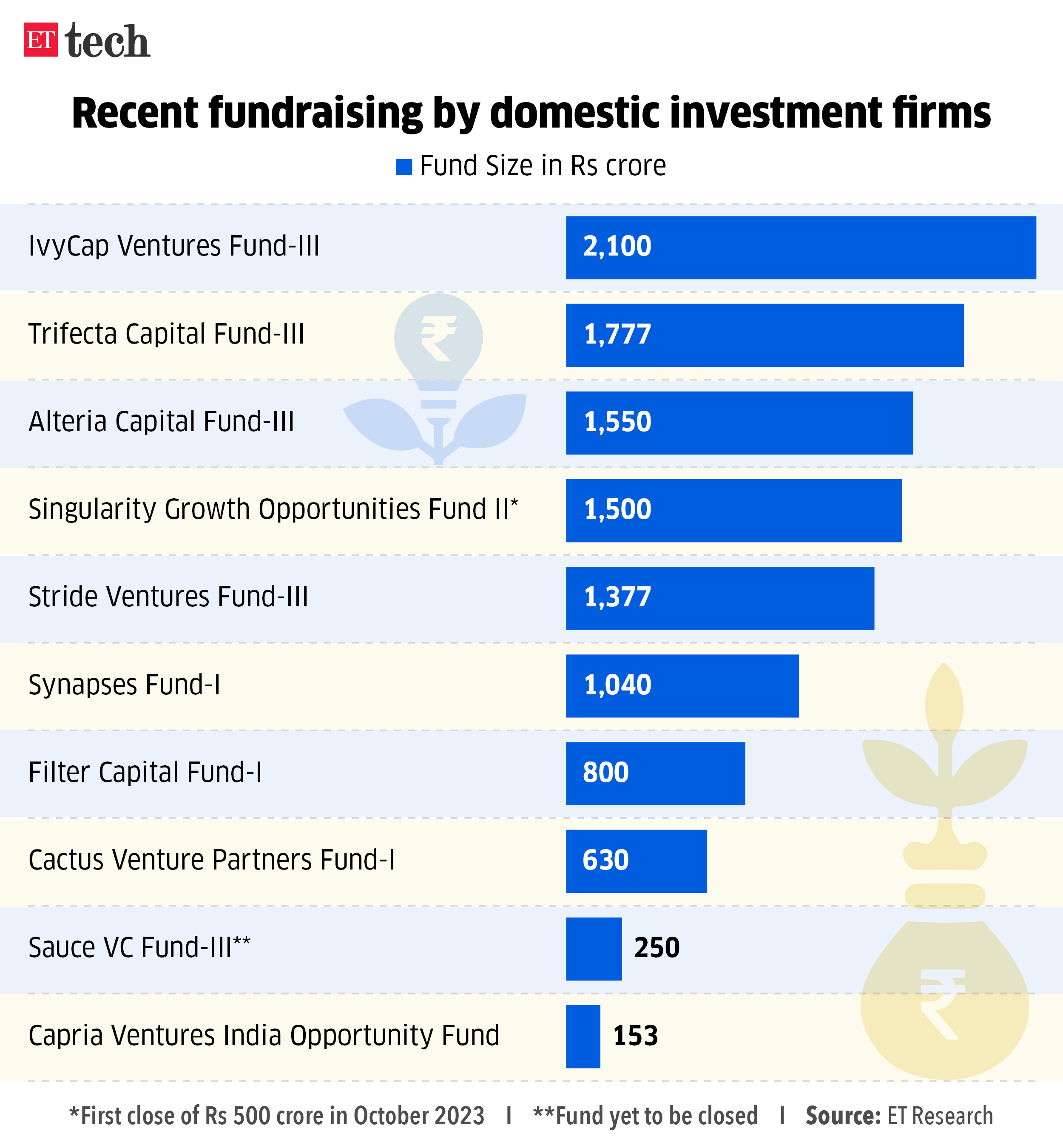

New Delhi-based investment firm Sauce VC, which has backed new-age luggage brand Mokobara, healthy foods startup The Whole Truth and petcare firm Supertails, aims to raise Rs 250 crore for its third fund. This comes as D2C firms see growing interest from risk capital investors. The firm looks to back 15-16 consumer brands in their early stages.

ETtech

ETtechConsumer-focused investor Sauce VC, which has backed new-age luggage brand Mokobara, healthy foods startup The Whole Truth and petcare firm Supertails, has launched its third fund with a target to raise Rs 250 crore, founder and managing partner Manu Chandra told ET.

The New Delhi-based investment firm received clearance from the Securities and Exchange Board of India (Sebi) a few weeks ago for the new fund, Chandra said, adding that it aims to back 15-16 consumer brands in their early stages.

Elevate Your Tech Prowess with High-Value Skill Courses

| Offering College | Course | Website |

|---|---|---|

| MIT xPRO | MIT Technology Leadership and Innovation | Visit |

| IIT Delhi | Certificate Programme in Data Science & Machine Learning | Visit |

| Indian School of Business | Professional Certificate in Product Management | Visit |

Sauce VC’s new fund comes at a time when the direct-to-consumer (D2C) space is seeing growing interest from risk capital investors, including tech-focused firms, as reported by ET earlier.

The fund will predominantly raise capital from domestic limited partners, or sponsors that back venture firms. Sauce VC is also looking to pick up funds from its existing backers, which include family offices and corporate houses focused on consumer sectors.

Sauce VC’s first fund was Rs 60 crore in size which closed in 2019 with the second edition in 2021 snagging a Rs 158 crore corpus. The firm had also racked up a Rs 260 crore continuity fund to back winners from its earlier vehicles.

ETtech

ETtechHowever, Chandra said they were doing away with the strategy of raising continuity funds, and will instead make larger ticket size investments from the main fund itself.

“We want to remain consistent with this new fund in terms of stage, sector and size,” he said. “Sauce now has a very deep ecosystem and tested playbook to take brands from an idea stage to Rs 150-200 crore scale consistently. We took pre-revenue bets in Mokobara, Hocco Ice Creams, The Whole Truth and many others and hope to find many more exciting brands and founders to back at the ideation stage itself.”

Through Fund-III, Sauce VC will cut cheques in the Rs 3.5-4 crore range, compared to Rs 2-2.5 crore deals it entered through its earlier vehicles.

“Ticket size has definitely increased,” Chandra said. “When we started out in 2019, there was no quick commerce. Now all the last mile infrastructure, tech stack, payments stack, everything has been solved for consumer brands, and brands are becoming bigger much sooner.”

Investment strategy

Sauce VC will continue to remain specialised on the consumer space while keeping its corpus relatively smaller to other venture firms.

In October 2023, DSG Consumer Partners – another VC firm focused on D2C space – raised its fourth fund with a corpus of $114 million (or around Rs 950 crore).

Similarly, Fireside Ventures, in October 2022, closed its third fund of $225 million (around Rs 1,800 crore).

Also read | Offline stores are trending as new set of D2C firms emerge

“The India domestic consumption opportunity is massive,” Sauce VC’s partner Yash Dholakia said. “Limited partners are keen to invest in this space across stages. A differentiated approach to entering early and taking concentrated bets… is working for Sauce. We want to continue to play this small role in the ecosystem doing the 0 to 1 and subsequently partner with larger, later stage investors for further rounds.”

In terms of investment opportunities, Chandra said that the firm will look at startups in segments with large markets and dominant incumbents.

“Generally, these incumbents are growing through penetration and less through innovation because if they innovate, they cannibalise their own products. New consumer segments are emerging but old brands struggle to cater them. So we look at younger brands, which are targeting a specific segment and are able to grow well,” he said.

ET had reported on May 12 that investors in the D2C space are increasingly focusing on brands targeting GenZ consumers, who do not want to use brands popular among previous generations.